We recently came across two charts that provide valuable lessons from past stock market crashes.

The first chart uses data from Dimensional Fund Advisors and shows the 1-year, 3-year, and 5-year returns of a balanced portfolio (60% stock / 40% bond) in the years following recent market crises:

The point being, if you don’t allow a market crisis to scare you off of your investment plan, you will probably be rewarded for staying the course, and likely in the not-too-distant-future.

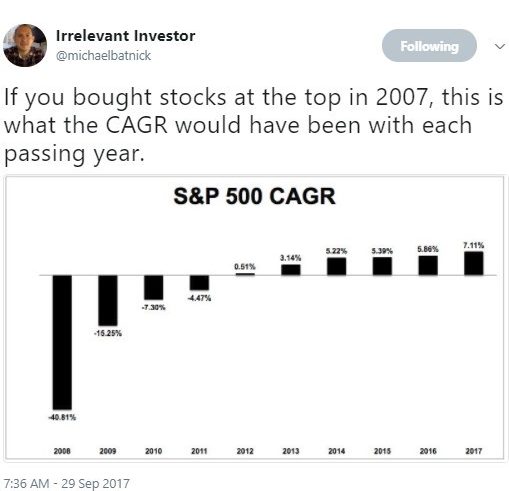

The second chart was provided by a respected industry peer, Michael Batnick. It shows the annual growth rate of the S&P 500 assuming you purchased the market index at its height in 2007.

The point here is that even if you invested at the worst possible time – on the exact day before the worst stock market crash in several generations — it only took five years until your return was positive and ten until it was pretty much “normal.”

Nobody knows when the next stock market crisis will occur – or what might cause it – and we would never attempt to predict that. But accepting that such declines will inevitably occur again during our investing lifetimes, it is worthwhile to emotionally prepare ourselves. Learning the lessons of past crises helps us to do so.