Last week, we emailed our clients to address anxiety over the upcoming election and its potential impact on their portfolios. Figuring that others might appreciate our viewpoint, below is the entirety of that email.

To our clients,

With the presidential election a little over a month away, we know that anxiety may be running high. The election’s impact on the stock market and your portfolio may be one item on the long list of things about which you are anxious.

We’re not foolish enough to predict the outcome of the election nor the level of social unrest that may follow, but even if we could, we know better than to let those predictions factor into investment decisions. It’s reasonable to worry about the potential market volatility that might surround the election, but if the past six months have reinforced anything, it’s that it is not possible to reliably predict the stock market’s short-term reaction to specific events, and that it’s our responsibility to encourage you not to allow any such predictions to inform your investing.

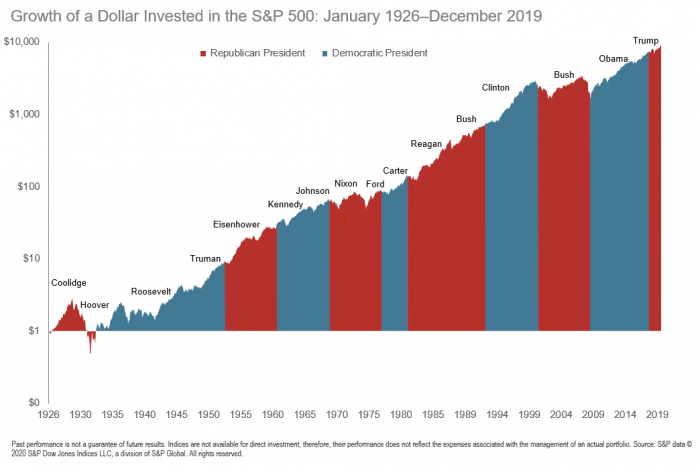

As for the long-term implications of one political party or the other winning the presidency, the data is pretty clear – the party in office provides no predictability on stock market returns, and of course the long-term trend is overwhelmingly upwards:

There is no denying the uniqueness of the upcoming election, its candidates, and the general state of the world, but consider all of the tragic world events and social unrest that have occurred during the period charted above. Your challenge – and it’s not an easy one – is to stay invested (and continue investing new dollars) through it all.

Everyone reading this email has a written investment plan specific to your unique circumstances and goals. That plan anticipates political, social, and economic shocks, even if we can never predict what will trigger the next one or what its impact will be. We remind you of the language included in most of your written plans:

Importantly, we do not intend to deviate from this plan as the result of political events, macroeconomic trends, scary financial headlines, or anything else that would require us to predict the market’s short-term response, which the evidence overwhelmingly suggests is difficult (or impossible) to do. Instead, we will revisit your portfolio risk allocation only when your lives change such that your ability, need, and willingness to take risk change.

None of this is to say that you shouldn’t be concerned about the election or its broader implications for society. We share those same concerns. The best way to counteract those anxieties may be to find productive ways to take action and feel like you are contributing to the result. The best approach for your portfolio is to do the opposite.

All the best,

Andrew, Tom, and Patrick