By managing all of a client’s accounts as a single, holistic portfolio, we’re able to implement a strategy of tax-efficient fund placement (also known as “asset location[1]”). This technique is especially valuable for high-earners in high marginal tax brackets.

Because certain asset classes are more tax-efficient than others, two portfolios with identical pre-tax returns can experience significantly different after-tax returns depending on where the assets are “placed” across the various accounts comprising the portfolio. Once we have determined the right asset allocation for a client (i.e., the percentage of the portfolio that we will target for each asset class)[2], we carefully consider the optimal location of each asset class to maximize the portfolio’s tax-efficiency.

To be more specific, we carefully consider which mutual funds and ETFs (hereafter both referred to simply as “funds”) to place in tax-advantaged accounts (IRAs, Roth IRAs, 401(k)s, etc.) and which to place in taxable accounts (brokerage accounts owned by individuals or trusts that are not considered qualified retirement accounts) so as to minimize the difference between the portfolio’s pre-tax and after-tax returns.

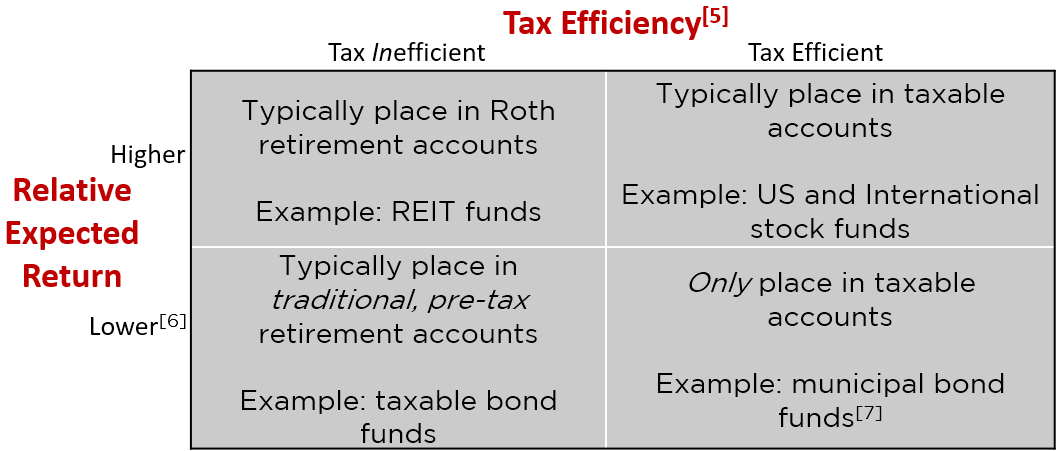

The optimal placement of a given fund depends primarily on two characteristics of the underlying asset class owned by the fund[3]: its tax-efficiency and its expected return. A simplified framework is as follows[4]:

Some important considerations before implementing tax-efficient fund placement:

First, this strategy assumes that all of a client’s accounts should be managed holistically, which rests on the assumption that all of the money in all of their accounts is intended for the same goal (typically the client’s retirement/financial independence). This is true for Geometric’s clients because we carefully segregate money needed for short-term goals as well as any accounts intended for longer-term goals other than the client’s retirement/financial independence (e.g, 529 accounts for education goals or Donor Advised Funds for charitable goals).

Next, in order to implement this strategy, the client needs to be comfortable that each of their accounts will get different returns and instead focus on the overall after-tax performance of the aggregated portfolio. Moreover, the client needs to be comfortable that the investments in a given account may look strange if viewed in isolation. For example, ideal tax strategy often dictates that much or all of an investor’s 401(k) be invested in bond funds, which can be counter-intuitive for a mid-career professional and may look odd when considered in isolation, rather than as just one piece of the overall puzzle.

Lastly, while perfectly optimizing a portfolio according to the framework above would sometimes suggest that all of a client’s taxable bond funds be placed in their tax-advantaged accounts, meaning their taxable account would hold only stock funds, we have learned that reality (specifically the unpredictability of life!) requires a slight adjustment to this approach. Even if the client expects that all of the money within the holistically-managed portfolio will be used for the same long-term goal (and therefore money won’t be withdrawn from the portfolio in the short-term), a client’s goals can change quickly[8] and their portfolio should be flexible enough to easily allow for unplanned withdrawals.

Specifically, because stock funds are more likely than bond funds to either (1) go down significantly in value or (2) have material unrealized capital gains that would be realized if sold, and because any withdrawals from our (mid-career) clients’ portfolios would need to come from their taxable accounts for the foreseeable future (because tax-advantaged accounts typically have penalties for early withdrawals), the “perfectly tax-optimized” portfolio construction could backfire should they ever need to make an unexpected withdrawal. For that reason, we generally place a portion of each client’s bond funds in their taxable account – doing so makes it more likely that they could liquidate some of their portfolio at any time with more confidence in the available balance and without material tax consequence. We manage this inevitable trade-off (between perfect tax optimization and liquidity considerations) on our clients’ behalf.

Tax-efficient fund placement requires some upfront and ongoing effort to optimize, but executed correctly it can be a powerful wealth-building strategy for high-earners.

[1] Not to be confused with asset allocation.

[2] For an explanation of the asset classes in which we invest client portfolios, see here. Note that asset allocation is far more important to an investor’s outcome than is asset location!

[3] One downside of “all-in-one funds” – such as Target Retirement Date funds – that hold multiple asset classes within a single fund is that they do not allow the investor to implement a tax-efficient fund placement strategy. That said, for do-it-yourself investors who are unlikely to implement this strategy on their own, we still like (and often recommend!) all-in-one funds due to their simplicity.

[4] For a more detailed explanation of the logic and math underlying the ideal placement for each asset class, please contact us.

[5] While there are several factors to consider when evaluating the tax efficiency of a given asset class, the primary driver is the nature of its expected returns. All else equal, asset classes for which the majority of expected return comes from capital appreciation (which is taxed as capital gains) are more tax-efficient than asset classes for which the majority of expected return comes from income (taxed as ordinary income).

[6] A logical question would be “Why invest in lower-return asset classes in the first place?” For an explanation, see here.

[7] Note that Geometric does not typically invest client portfolios in municipal bond funds, the reason for which is outside the scope of this post.

[8] The most frequent example being a client deciding to buy a new primary or vacation home without sufficient advance planning, meaning they had not yet built up the necessary cash outside the portfolio for the down payment and thereby requiring a withdrawal from the portfolio for that purpose. We don’t view this as a problem – clients have the right to change their minds and spend their money on whatever optimizes their lives!